Published in partnership with PayPlan

The use of bailiffs has increased in recent years. Enforcement action can be distressing, and support for dealing with bailiffs can be difficult to find. Why has this rise occurred, and what changes are being proposed?

Increased bailiff action

Council tax arrears are now the fastest-growing form of debt. To give an idea of the scale, 44% of people who contact us need help with priority arrears, which includes council tax.1

Reasons why people fall behind

People can fall into arrears for many reasons, often through no fault of their own, including:

- Job loss or reduced income

- Ill health

- Changes in personal or family circumstances

Why council tax specifically?

Under the current system, council tax debt can escalate very quickly. After a missed payment, a council may request the full year’s bill within a short timeframe, depending on local authority processes.

If this isn’t paid within a week, the council can apply for a liability order, which allows them to pass the debt to enforcement agents (bailiffs).

Investigations into council tax debt

A BBC investigation found that households owe £6.6bn in council tax to local authorities in England.2

This sharp rise in arrears has led campaigners and charities to call for changes to the recovery system, with a focus on earlier support and affordability, rather than relying on bailiff action as a default.

Proposed changes

Suggestions for reform include:

- Slowing down the collection process

- Taking a person’s circumstances into account earlier

- Limiting the additional costs and fees that can be added

There are also proposals to mirror the government’s ‘Tell Us Once’ service – which automatically notifies multiple departments automatically after someone passes away – to make changes to council tax status simpler and more joined up when circumstances change.

The overall aim is to make the system easier to navigate and to give people clearer, more flexible ways to repay arrears.

Routes to change

The Enforcement Conduct Board (ECB) has been created to provide independent oversight of the debt enforcement sector in England and Wales.3

Its aims include:

- Improving how enforcement firms and agents identify and support vulnerable people

- Increasing the use of sustainable repayment arrangements where people can’t pay in full straight away

From 1 January 2025, the ECB started handling new complaints about the conduct of enforcement agents or firms where individuals feel their complaint hasn’t been dealt with fairly or in a timely way by the enforcement company itself.

This is intended to strengthen accountability and improve protections, particularly for vulnerable people.

Why the ECB exists

The ECB works to identify practices that may cause harm, especially to vulnerable clients.

They consider a range of vulnerability indicators, including:4

- Mental health conditions

- Severe or long-term illness

- Financial hardship

- Domestic or economic abuse

Finding support if you’re facing bailiff action

If you’re facing bailiff action, you don’t have to deal with it alone. Support is available, and it’s often possible to explore options before things escalate further.

Our advisors can talk you through what support may be available to you and help you understand your options.

If you are struggling with debts call us on 0800 072 1206. We’re open from 8am – 8pm Monday to Friday and 9am – 3pm on Saturdays.

Alternatively, you can visit our www.payplan.com/police to speak to us via live chat or more information

[1] The growing problem of local authority bailiff use – Money and Mental Health Policy Institute

[2] Council tax: Households owe billions ahead of bill rise – BBC News

[3] Fairer system for debt collection to boost protections for financially vulnerable – GOV.UK

[4] Why Enforcement Needs to Embrace Shared Vulnerability Data

The difference between priority and non-priority debts (and why it matters)

Published in partnership with PayPlan

With so many types of debt, it can be hard to know which should be paid first. Understanding the difference between priority and non-priority debts helps you budget more effectively and stay in control of your money.

What are priority debts?

Priority debts are those that must be paid to avoid serious consequences – from losing access to essential services to facing legal action.

That’s why these debts are called priority debts – they should always be paid first over other debts.

What happens if I don’t pay priority debts?

The consequences depend on the type of debt and can include:

- Bailiff action – for example, if you don’t pay your council tax, gas and electricity bills.

- Disconnection of utilities – if gas or electricity bills remain unpaid.

- Losing your home – in the most serious cases, missed rent, mortgage or secured loan payments can result in eviction or repossession.

- Repossession of a vehicle on finance – if you fall into arrears.

What types of priority debts are there?

Common priority debts include:

- Mortgage or rent arrears

- Council tax arrears

- Gas and electricity arrears

- HMRC

- TV licence fines

- Court fines or child maintenance

- Hire Purchase (HP), Personal Contract Purchase (PCP) or Lease Agreement arrears

What are non-priority debts?

Non-priority debts are still important – but the consequences of missed payments are generally less severe. They don’t usually put your home or essential services at immediate risk.

What happens if I don’t pay non-priority debts?

If you fall behind on these, you could face:

- County Court Judgments (CCJs) – creditors may take legal action to recover what you owe.

- Debt collection – your debt could be sold to another company that pursues repayment.

- Damage to your credit file – missed payments can lead to default notices and harm your credit rating.

What types of debt are non-priority?

Common non-priority debts include:

- Credit cards

- Personal loans

- Store cards or catalogue debts

- Overdrafts

What this means for your budget

When managing your household budget, always make sure priority debts are covered first – they carry the most serious consequences if left unpaid.

Once those are managed, focus on non-priority debts. Keeping up with minimum payments, where possible, can help prevent defaults while you explore longer-term solutions.

We’re here to help

If you are struggling with debts call us on 0800 072 1206. We’re open from 8am – 8pm Monday to Friday and 9am – 3pm on Saturdays.

Alternatively, you can visit our www.payplan.com/police to speak to us via live chat or more information.

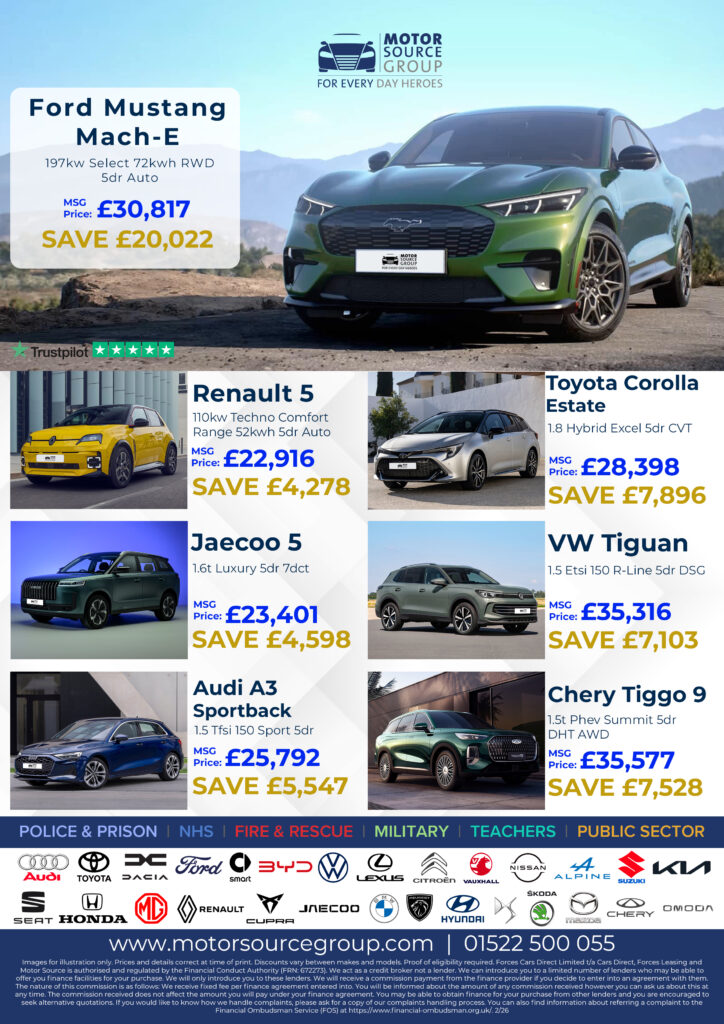

Motor Source Group Offers – February 2026

This February, fall in love with driving again with some incredible offers, including the Ford Mustang Mach-E with savings of over £20,000, or the Chery Tiggo 9, offering premium space and luxury with a saving of £7,528.

Our dedicated team is on hand to answer any questions and help you make the right decision on your new car.

Uniform Mortgages Surgery – February 2026

Zero Charge For Mortgage Advice

Virtual event on 6th February 2026 at 10:30 – 15:30 With Uniform Mortgages

Uniform Mortgages are running an independent, no obligation mortgage advice clinic to help you secure a competitive rate. We can also secure a rate up to 6 months in advance – so if you have a mortgage now and your fixed rate will be expiring within 6-7 months then please contact us to speak to a Mortgage Advisor today with your requested date, time and best contact number.

If you are interested but unable to attend you can also arrange an appointment at a mutually agreeable time with the Uniform Mortgages team.

To book an appointment please call 01767 316626 or email info@uniformmortgages.co.uk with your requested date, time and best contact number.

If you are interested but unable to attend the clinic you can also arrange an appointment at a mutually agreeable time with the Uniform Mortgages team.

When to seek debt advice and what you can expect from PayPlan

January can be a tough month financially. You may have overspent at Christmas, be catching up on bills or finding that everyday costs are higher than expected.

When money feels tight, the pressure can build quickly – and worrying about debt can feel overwhelming.

Confidential debt advice is available and reaching out early can make a real difference.

When should I get debt advice?

Getting advice sooner rather than later can help prevent your situation from becoming harder to manage. It may be time to seek support if:

- You’re missing or delaying payments, or your budget isn’t stretching to the end of the month

- You’re relying on credit to cover essentials like food or utilities

- You’re worried about creditors contacting you or chasing payments

- Your mental health is being affected by financial pressure

- Your income has changed and you’re struggling to keep up with bills

- You’re feeling overwhelmed and unsure what to do next

Even if you’re not in arrears, early debt advice can help you understand your options and prevent things from worsening.

You don’t need to be in crisis to get support – debt advice is there for anyone who feels unsure or unsettled about their finances.

What you can expect when you contact PayPlan

Whether you come to us directly or are referred by one of our partners, you‘ll speak with a trained advisor who will take time to understand your income, bills, debts and personal circumstances. This helps us provide advice that reflects your situation and what you’re experiencing.

We can support you by phone, WhatsApp, email or Live Chat – whichever feels most comfortable for you. There’s no rush; you can pause and return to the conversation whenever you need time and space.

Your first conversation will usually include:

- A simple income and expenditure budget

This helps you see your full financial picture and may highlight costs you haven’t considered, such as gifts or clothing. - A discussion about your debts and circumstances

This ensures any advice you receive is tailored to your needs. - Clear information about the options available

We’ll explain each debt solution, answer your questions and help you understand what feels right for you.

What you can do next

If you are struggling with debts call us on 0800 072 1206. We’re open from 8am – 8pm Monday to Friday and 9am – 3pm on Saturdays.

Alternatively, you can visit our www.payplan.com/police to speak to us via live chat or more information

How to talk to your partner about money worries

Money can be one of the most emotionally loaded topics in any relationship. If you’re worried about rising bills, overspending after special occasions or an unexpected expense, talking about money can feel stressful or awkward. Avoiding the conversation doesn’t make the problem go away though.

Here are some tips on how to start an open, supportive conversation with your partner to help you get back on track with your finances.

Pick the right moment

Avoid bringing it up in the middle of an argument or an already stressful situation. Try to choose a neutral time when you’re both well rested.

Be honest and avoid blame

Share your feelings on the subject rather than pointing fingers It’s a shared challenge you’re facing together. Instead of saying “we spend too much and we’re in trouble”, try “I’m worried about our finances, could we have a look together and make a plan?”

Focus on shared goals rather than the past

Conversations often go wrong when they turn into a review of who did what. Set joint goals such as paying off debt, creating a budget or building an emergency fund and work together as a team.

Be open about what’s worrying you

Don’t hold back details that affect the bigger picture. Sharing things like “our credit card balance is growing” or “I can’t manage the bills on my own.” helps you both understand what needs attention.

Create a plan together

a simple, actionable plan may reduce money worry. We recommend:

- Creating a monthly budget

- List all your debts and noting the payments that are due

- You may want to speak to your creditors if you’re worried about repayments

- Reviewing your subscriptions and cancelling any you don’t need

- Agreeing to check in on your finances regularly

- Reaching out for debt advice if needed

Keep talking

One conversation probably won’t solve everything, so keep checking in with each other. The aim is to make money a topic you can talk about openly without anxiety.

If it doesn’t feel safe to talk

If discussing money feels unsafe, or you’re worried about how your partner may react, support is available You can contact the National Domestic Abuse Helpline on 0808 2000 247 for confidential advice at any time.

What you can do next

If you are struggling with debts call us on 0800 072 1206. We’re open from 8am – 8pm Monday to Friday and 9am – 3pm on Saturdays.

Alternatively, you can visit our www.payplan.com/police to speak to us via live chat or more information

Police Mutual Q1 Prize Draw

It’s prize draw time!! Police Mutual are giving Police Officers, Staff, PCSOs, Special Constables and their families the chance to enter a FREE prize draw to win 1 of 4 £600 e-gift cards from a supermarket of their choice, choose from Asda, Marks & Spencer, Sainsbury’s or Tesco.

For prize draw details and to enter click here: https://bit.ly/484OUTO

Terms and conditions apply: https://bit.ly/4pN4dq9

Prize draw ends 31/03/2026.

Please be aware that the link may not work on job computers due to the Force firewall, therefore

please try personal devices as an alternative.

Important Information

The prize draw will take place on 01/04/2026. Prize will be delivered within 48 days of the draw. The prize draw is open to UK residents aged 18 and over. You must be eligible for Police Mutual products. No purchase necessary. One entry per person.

PMGI Limited, trading as Police Mutual is authorised and regulated by the Financial Conduct Authority. Financial Services Register No.114942. Registered in England & Wales No.1073408. Registered office: Brookfield Court, Selby Road, Leeds, LS25 1NB.

Changes to the Lifetime ISA could be on the horizon

At Police Friendly, we wanted to let you know about a key announcement in the recent Budget about the Lifetime ISA (LISA) – and what it could mean for members of the Police Family.

The Government plans to launch a consultation next year on a new ISA for first-time buyers. This new product may replace the current Lifetime ISA, meaning time could be running out to secure one under today’s broader rules.

Right now, you can save up to £4,000 in a LISA* each tax year and receive a 25% tax-free Government bonus of up to £1,000 annually. Family members can contribute, and you’ll get the 25% bonus on any payments they make too. Our LISA also offers additional tax-free bonuses.

The current Lifetime ISA can be used for your first home or for retirement from age 60. Under the new proposal, the 25% Government bonus may only be added when you buy a home, removing the yearly bonus boost that helps your savings grow even more.

If you are under 40 and don’t yet have a LISA, now could be the time to open one while you can still secure up to £1,000 tax-free from the Government each tax year.

If you already have a LISA, make sure you’re paying in the full £4,000 each tax year to receive the maximum £1,000 tax-free annual bonus.

Plus – we’ve extended our Lifetime ISA Offer for Federation Members! Open a new Lifetime ISA by 31/12/25 quoting AUTUMN25 and receive a £50 Amazon.co.uk Gift Card. T&Cs apply.

*Lifetime ISA qualifying rules apply. See our website for details

Need any help? Call 01689 891454 to talk to one of our friendly, UK-based team. Our lines are open Mon-Thurs 8:30-5:00pm and Fri 8:30-4:30pm.

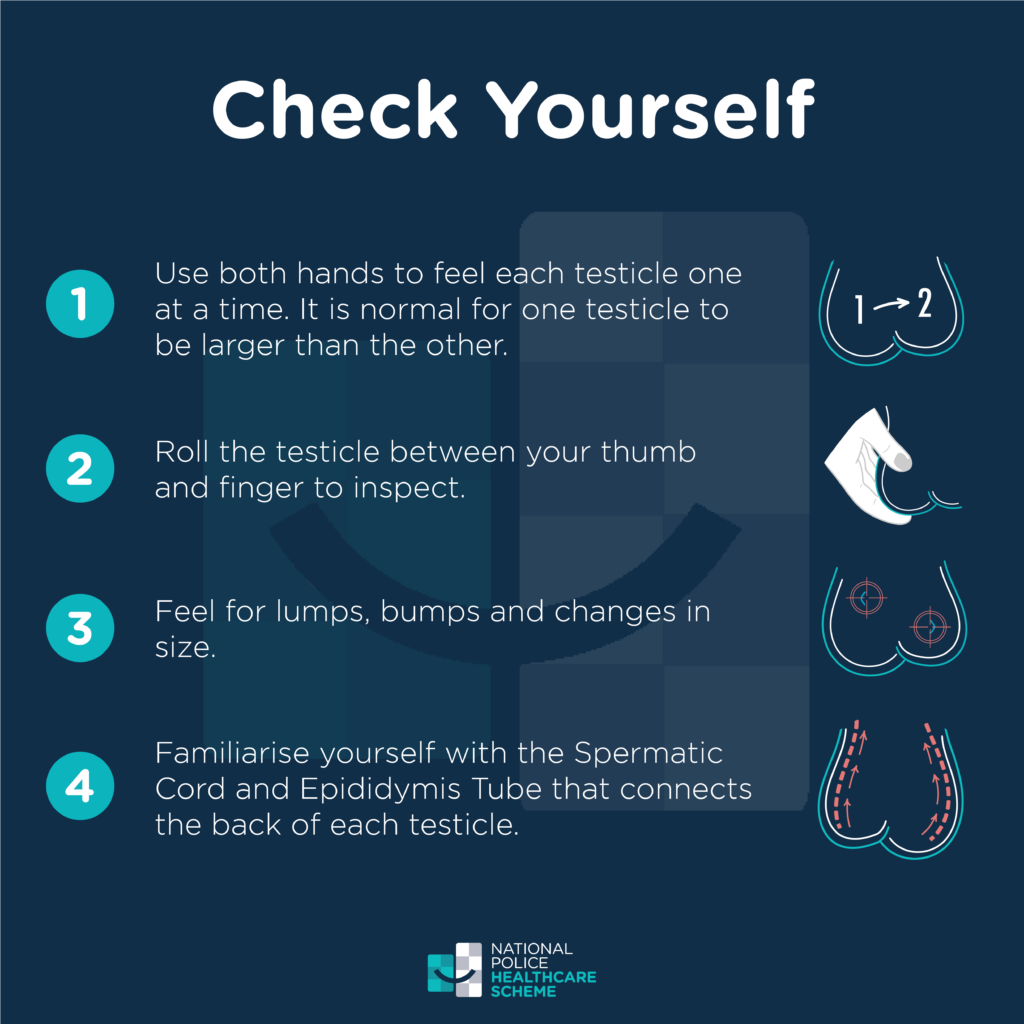

Men’s Health Month: Check Yourself

We’ve teamed up with the National Police Healthcare Scheme to remind every man to: take a couple of minutes and check yourself.

Regular self-checks and acting early can save lives.

Regular self-checks and acting early can save lives.

Testicular cancer is one of the most treatable cancers when caught early – so don’t wait, don’t guess, and definitely don’t ignore something that doesn’t feel right.

Check out our simple 4-step diagram to learn what ‘normal’ feels like.

If something feels off, unusual, or worrying? Get checked. No delay. No embarrassment. Just action.

Have a look at the National Police Healthcare Scheme’s latest blog to see what else you can do to protect and prioritise your health, not just this month – but always: https://bit.ly/49ExsXj

Have a look at the National Police Healthcare Scheme’s latest blog to see what else you can do to protect and prioritise your health, not just this month – but always: https://bit.ly/49ExsXj

#MensHealthMonth #CheckYourself #TesticularCancerAwareness #MensHealth #PoliceFederation #NPHS